4211Views 0Comments

Staking rewards – How to generate passive income

Blockchain technology has evolved significantly since its inception in 2009. Today in 2022, there’s never been more opportunities to generate passive income simply by holding your cryptocurrency. This process is called staking. With the same goal as mining, staking is intended to create consensus across the entire blockchain network. Without requiring expensive hardware or large amounts of electricity, staking is a very attractive way for investors to earn crypto and benefit from blockchain technology. Staking rewards are most commonly expressed in APY, (Annual Percentage Yield) which indicates how much staking rewards you are likely to receive over the period of 1 year.

What is staking? How can you benefit from it and earn passive income from staking? In this article we will explain the ins and outs of staking and explain how you can start generating passive income on the Bithotel platform today.

What is staking?

A fundamental element of a blockchain network is the ability to create consensus about the record of transactions that took place in the network without any central authority. Staking is one of the two main mechanisms by which this network-wide consensus is created. Through these mechanisms transactions on the blockchain are validated and cleared in a decentralized fashion. When the Bitcoin network launched in 2009, it used mining or Proof-of-work as its consensus mechanism. While Bitcoin is still using Proof-of-Work today, it has significant downsides: High upfront costs for mining hardware and high electricity costs. The first staking or Proof-of-Stake based blockchain was launched by Peercoin in 2012. Today most next-generation blockchains have adopted the Proof-of-Stake model with many blockchains offering users the possibility to stake their holdings.

The idea that underpins staking is that as a stakeholder, a user is incentivized to not manipulate the blockchain. Doing so would harm their own investment. In order to manipulate the blockchain a user or group of users would have to own 51% of the staked cryptocurrency. This is referred to as the 51% attack. It is very expensive to control 51% of staked cryptocurrency. Furthermore, blockchains employ additional security measures in place to prevent 51% attacks and ensure the security of their network. For example, in case of Ethereum’s staking, if a 51% attack occurred, the honest validators in the network would vote to ignore the manipulated blockchain. The offenders staked ETH would consequently be burned and removed from the circulating supply. This incentivizes validators to act in good faith to benefit the cryptocurrency and the network.

In practice, staking simply involves holding the cryptocurrency in a wallet that supports staking for a specific coin or network in order to receive the staking rewards. In some cases, a minimum amount of tokens is required to stake them. Also, some coins or tokens offer the possibility to lock your tokens for a minimum period of time, this locking of tokens is incentivized by allocating additional staking rewards for locking the cryptocurrency. Once you start staking, your holdings are used to verify transactions and guarantee the validity of the next block of transactions with your own stake in the network.

locking tokens in a smart contract, so there is a locktime, APR, max capacity of a pool, and different kinds of pools (multi token versus single token pools

how this APR / Yield on some pools are even generated (eth = just printing more eth, but Uniswap staking pools for instance is based on trading fees in their Dex) → so inflationary rewards (also like Anchor, should be talked about!) versus more robust reward systems for staking. Also liquidity farming and terms like that should be talked about as it involves locking tokens too! I would put the Consensus mechanisms in a seperate paragraph.

how to get the highest rewards and what sort of staking there is to optimize for that. How Aave and Compound generate their yield and how many staking platforms (some of which you should name) connect to these types of pools to allow you to earn rewards. Also talk about platforms that pay APR in their native token, which you should look out for as this is often very risky. Talk about how those two token pools often work and what impermanent loss is (and other reasons why this staking is risky. Remove all the types of staking except Original proof of stake. Add other types of staking (or more generally locking tokens for yield) on top of that.

In contrast to Proof-of-Work there are multiple variants of Proof-of-Stake mechanisms in existence:

- Original Proof of Stake

- Leased Proof of Stake

- Pure Proof of Stake

- Proof of Importance

- Liquid Proof of Stake

- Proof of Validation

- Proof of Authority

- Hybrid Proof of Stake

- Delegated Proof of Stake

What unifies all these methods is that users need a stake in the network to participate and receive staking rewards.

How does it work?

The goal of validating transactions is the production of new blocks. Block productions and validation is done by stakers, some of the stakers also function as validators. In the Original Proof-of-Stake mechanism validators are selected at random to prevent manipulation of the blockchain. When a random validator has been selected, the validator will check the block and assess its validity by comparing it to a base value derived from other validators in the network. In exchange for this, the validator receives a block reward. Once the parameters are accepted, the validator will pass on the transaction to a node which will add it to a blockchain. Nodes are larger stakeholders which are responsible for the following:

- Nodes determine whether a block of transactions is legitimate and accept or reject it

- Nodes are responsible for storing blockchain transaction history

- This transaction history is broadcast by nodes to other nodes that may need to synchronize with the blockchain and update its transaction history

Notable examples of blockchains that utilize PoS include:

- Ethereum (Post-merge)

- Polkadot

- Solana

In other types of Proof of Stake mechanisms, the process can slightly deviate; below you can find examples of how several of the aforementioned Proof-of-Stake mechanisms differ from the traditional.

Delegated Proof-of-Stake (DPoS)

In DPoS network participants have the right to delegate the production of new blocks to a fixed number of delegates. These delegates are also known as witnesses. Users of the network decide which delegates will be able to validate new blocks through a voting system. Delegates are expected to behave honestly and preserve the integrity of the network. Since the voting system is continuous, ineffective delegates can be replaced by another validator at any time.

Notable examples of blockchains that utilize DPoS include:

- Cardano

- EOS

- Tron

Liquid Proof-of-Stake

Similar in its design to Delegated Proof-of-Stake the main difference with Liquid Proof-of-Stake is that holders can loan their tokens validation rights without relinquishing ownership of their tokens. With LPoS, delegation is optional. Another difference is that in LPoS the number of validator nodes is dynamic instead of fixed as is the case with DPoS.

Notable examples of blockchains that utilize DPoS include:

- Tezos – Proof of Authority (PoA)

PoA is a reputation-based consensus mechanism. In PoA-based networks, the validator role is designated to approved accounts. These approved accounts have to earn the right to become a validator and therefore have an incentive to retain their position. Because identity is attached to the validator role, validators want to maintain a good reputation. Failing to do so would result in their identities becoming attached to a negative reputation.

- VeChain – Proof of Importance (PoI)

Regular PoS consensus mechanisms only look at the total capital vested in a node, when deciding that node’s governance capabilities. In PoI additional factors are considered when determining each node’s influence. The criteria used in PoI networks varies but common criteria include the number of transfers a node has participated in over a period of time or how many different nodes are interlinked via clusters of activity.

- NEM – Proof of Validation (PoV)

In PoV each node within the system keeps a complete copy of the transaction history that is created on the blockchain, each user accounts public key, and which crypto tokens or coins that node owns. Users stake their coins inside these validator nodes, and this consequently determines how many votes each validator has. A new block becomes confirmed once a group of validator nodes with a minimum of two-thirds of the total voting power of said network sends a commit vote for that block.

- Cosmos – Hybrid Proof of Stake

Hybrid PoS protocols use a combination of consensus mechanisms. Generally, hybrid protocols are associated with mechanisms that are a combination of Proof-of-Work and Proof-of-Stake. But there are also hybrid chains that use a combination of PoS mechanisms.

Notable examples of blockchains that use hybrid mechanisms include:

- Binance Smart Chain (PoS & PoA hybrid)

Hot staking vs cold staking

A validator node is generally dedicated to hot staking. This means it must provide the minimal stake to the network and the wallet needs to be connected to the network at all times in order to validate blocks and generate staking rewards.

Cold staking requires you to delegate your coins to a validator, the coins do not need to be sent to a wallet that holds the minimum threshold for becoming a validator. Instead it signals the network it supports a certain validator with its funds.

Cold staking has advantages that are especially useful for retail investors; not only does it require less funds in order to participate in staking, but the wallet can be kept offline and still receive the staking rewards.

Coins vs Tokens

Staking rewards can be distributed for both coins and tokens. The difference between the two is that coins are native to their blockchains, which means that they are created at the blockchains inception, while tokens are created on top of an existing blockchain. Tokens use the consensus mechanism of the blockchain that they were created on. Furthermore, tokens can have extended functionality and their own tokenomics. Therefore, staking rewards and subsequent yield on a token, can differ from the yield from the native coin of that blockchain.

The extended functionality refers to the type of token and the utility that it has, generally speaking there are four different token types in existence:

- Payment tokens

A payment token is used to pay for different goods and services

- Utility tokens

Utility tokens grant holders access to goods or services

- Equity tokens

Equity tokens represent a set amount of stock or equity in a given company

- Security tokens

Most tokens that are issued during ICO’s (Initial Coins Offerings) fall into this category, they do not have a particular utility

Staking vs Lending

Staking and lending rewards are both expressed in APY (Annual Percentage Yield). The two should not be confused though, staking is the essential process of block validation on a network. Lending on the other hand, refers to DeFi (decentralized finance) protocols which revolve around lending your assets to earn interest on these assets. Both staking and lending can be used to generate passive income on your cryptocurrency holdings, but both have different implications for your investment.

How do I get started with staking?

There are many options across different blockchains and tokens for you to pick from. In some cases crypto exchanges support staking for coins associated with larger networks. You can refer to the documentation of specific exchanges to find out if they support staking and how staking rewards are distributed. If you want to have all the options available to you, you need a private wallet such as Metamask to participate. Once you’ve decided on a token that you are interested in staking, you need to identify the network that the token is operating on. Finally, you need to have the networks native token deposited in your private wallet so you can pay for the transaction fees that are associated with that network.

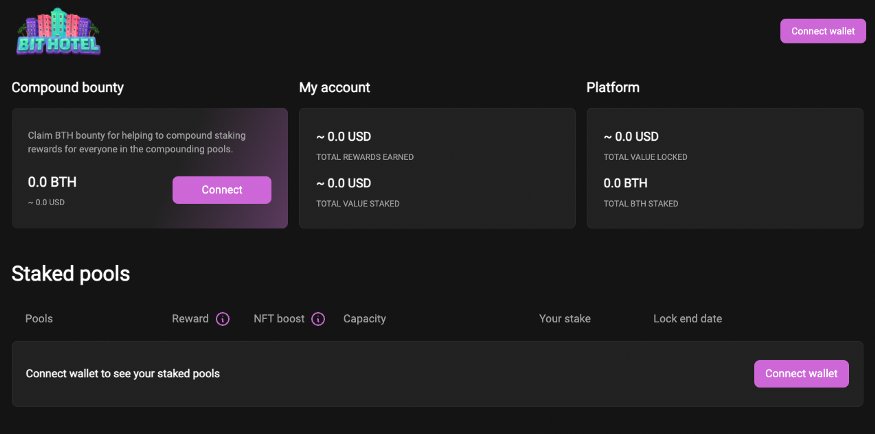

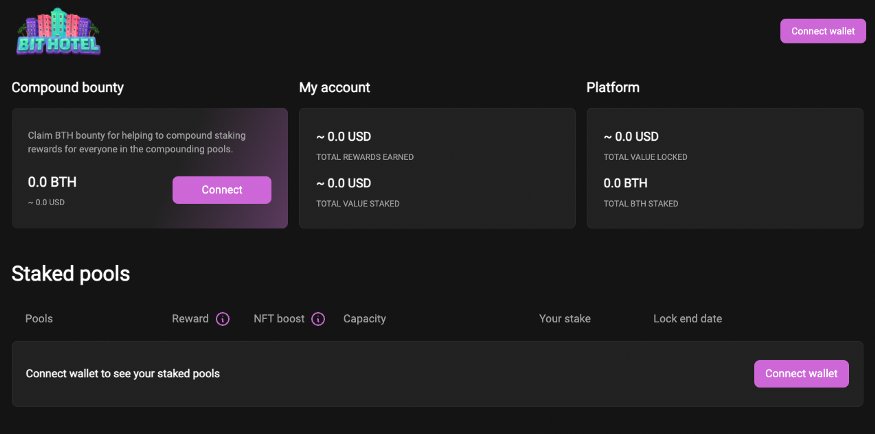

Bit Hotels token $BTH has a fully functional staking mechanism in place. Built on the security and reliability of the most popular blockchain in the world, Binance Smart Chain (BSC). Bit Hotel has built an intuitive staking dashboard to so you can easily track your $BTH holdings and staking rewards.

In the Bit Hotel dashboard you can see your total staked holdings, total staking rewards earned and claim your rewards. You can learn more about the Bit Hotel dashboard and how to start staking here.

Frequently asked questions about staking

Is staking safe?

Staking is viewed as a safe technology, blockchains are fully dependent on the success of their consensus mechanisms and well-known blockchains such as Ethereum or Binance Smart Chain are very safe to use.

Do I need a lot of money to start staking?

The initial investment you need to start staking depends on which wallet you are storing the coins in, and on the specific consensus mechanism of the blockchain you are using. Generally speaking, it is possible to start staking and receive staking rewards with a minimal amount of coins or tokens.

Are staking rewards stable?

This depends on how busy the network is. Blockchains have a mechanism that increases the staking rewards when the network has few active validators and decreases the rewards when staking becomes more popular on the network. Fluctuations are possible but in the long run, rewards tend to be relatively stable.